Read Time: ~5 minutes

Answer: “It Depends”

Well that probably wasn’t a very satisfying answer, was it? Probably not. So what I’ll attempt to do here is explain some of the methodology that goes behind assessing a business’ value. Spoiler – a lot of it has to do with the financials and profitability (shocker!) but other aspects like growth rate, team structure, industry, years in business, and others will have a heavy hand in the valuation as well.

My goal at the end of this is to give you a “range” that you could reasonably expect. Having sold my own business before, I knew very little about the business valuation process, as I was busy actually running my business! It wasn’t until I was approached to sell my business when a lot of this began to come into focus. So let’s get into it!

Defining “Multiples”

This is industry jargon but also most commonly used measuring stick for assessing the value of a business. It refers to a “multiple” of profitability. So if a business makes $100k/year in profits, a “2x multiple” would value the business at $200k. A “3x multiple” would value it at $300k (and so on).

The multiple is raised (or lowered) based on the perceived value of the business, and the business’ ability to transfer to a new owner and continue to run smoothly.

- You’ve increased revenue 3 years in a row? –> Higher multiple! 😀

- You have no employees and do all the jobs yourself? –> Lower multiple ☹️

But there’s numerous other factors that also going into applying that multiple (“perceived value”), which include but are not limited to…

- Industry? An industry on the decline is likely less attractive than one on the up and up.

- Growth Trajectory? Are you growing? shrinking? Both of these factors would impact the multiple in a large way.

- Customer Concentration? Does 1 customer make up 50% of your revenue? What happens if you lose that customer? Typically a well diversified clientele is more attractive that “many eggs in one basket”

- Recurring & Repeat Revenue? Are your customers on a contract (ex: HVAC contract)? Do they come back to you to continually get services performed (ex: Salon)? Having loyal, baked in customers is especially valuable to buyers!

- Keyman Risk? If the owner leaves, can the business stand on it’s own? What if the manager leaves, can things continue to operate? Buyers want to buy an operation, not a job, so having the pieces in place for the business to operate tends to be valued quite highly.

- Documentation and Systems? Are the accounting books clean and precise? Are there systems in place where everyone knows what to do and how to do it? This tends to help the valuation as there is more certainly that things will transition smoothly.

- How Profitable is the Business? The more profitable the higher the multiple! That’s right, it’s a compounding effect, where the denominator is larger and the multiple applied is bigger. Reason being – it’s just a heavy, well run, profitable business and in order to be competitive to buy businesses like that you need to put together a competitive offer.

But before we get into what those multiple ranges might look like, let’s first define “profitability”.

Defining “Profitability”

You’ve probably heard of EBITDA – it’s what Wallstreet uses to assess the profitability of mid to large cap companies. But for small businesses “SDE” is typically used, which refers to “Seller’s Discretionary Earnings”. By and large, they are very similar but with a few important differences…

EBITDA = Earnings Before Interest, Taxes, Depreciation & Amortization

SDE = EBITDA plus the owner’s compensation and perks (“Addbacks”)

In short, SDE implements “Addbacks” to the value of a business. Let’s use some real numbers to help illustrate this.

Business Revenue – $1,000,000

Expenses – $800,000

Business Profit – $200,000

Simple, right? The business makes $200k/year. However, that fails to capture the fact that the owner pays himself $100k/year in salary! So what is done is you “Add Back” that $100k because when the business transfers to the new owner they would effectively be getting that $100k in the form of profits as well.

But it does not only apply to owner’s compensation. Other common Add-backs include…

- Owner’s Personal Vehicle

- Owner’s Health Insurance

- Personal Travel/Meals

- Owner’s Retirement Contributions

- Charitable contributions

These would all be “added back” because these expenses wouldn’t apply to the new owner of the business. This makes the SDE number greater than the EBITDA number and thus more favorable to the seller!

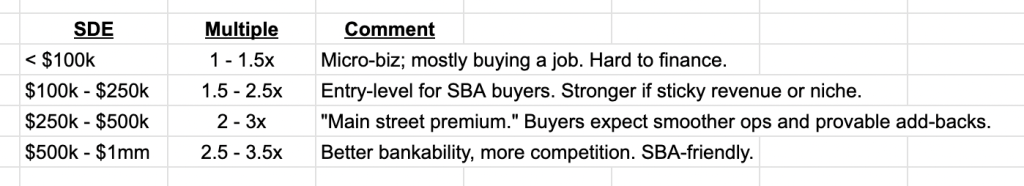

What’s a Fair Multiple?

Okay, now that we understand what multiples are and the preferred profitability metric (SDE) we can now begin to give ballpark ranges on what a fair market value might look like.

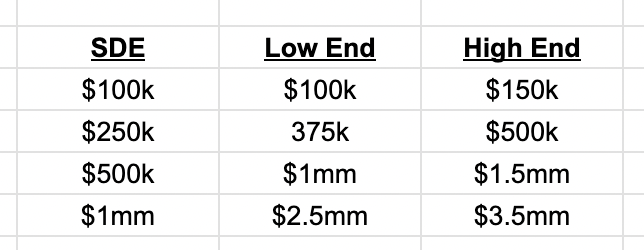

Now let’s apply some middle-of-the road SDE numbers to these tiers to see the valuation a little more clearly.

Above you’ll see that every SDE amount has a “range”, from low-end to high-end. This range is determined by the multiple applied.

Ex: Your company makes $500k/year in SDE. That typically fetches a 2-3x multiple, so…

- $500k x 2 = $1mm (low end)

- $500k x 3 = $1.5mm (high end)

And just to put a bow on it, once again, these are ballparks. Every business is different and multiples outside these ranges can absolutely apply given specific circumstances.

If you made it this far, thanks for reading! If you have any questions, please feel free to email me at Dave@Emerson-Endeavors.com.

-Dave

Leave a comment